Discontinuation of “Authorized Member Financed Activities” Category

It is now time to discontinue the “Authorized Member Financed Activities” category as the next step in implementing the changes approved by the Presiding Bishopric (see the notice “Donation Categories Simplification” dated 27 May 2022).

To discontinue this category, its balance and the balance of any custom subcategories within it must first be zero.

Target Date

All units are expected to set balances to zero in this category and its subcategories by August 31, 2022. Any remaining balance after that date will automatically transfer to Budget by the end of August. The “Authorized Member Financed Activities” category will not be available after August 31, 2022.

Instructions

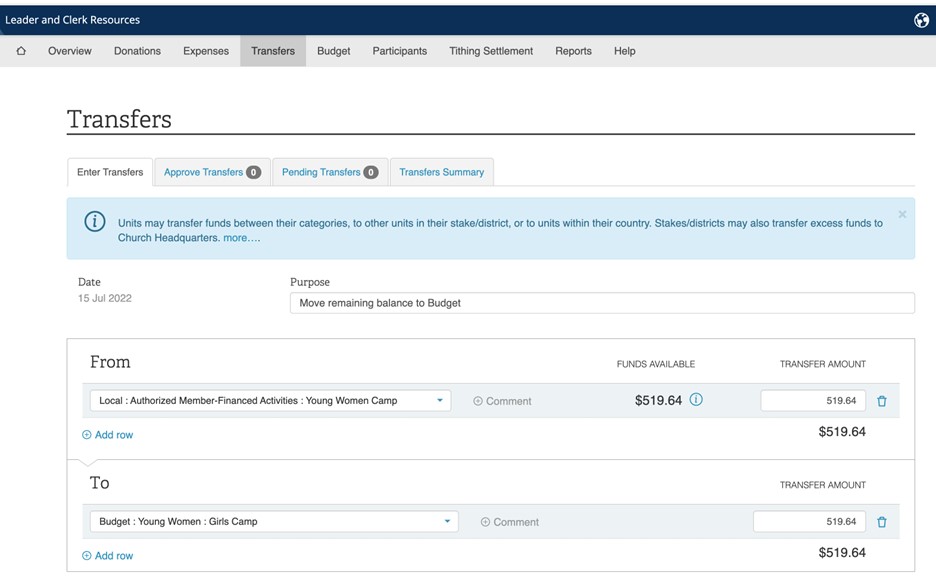

- Move all remaining balances in the “Authorized Member Financed Activities” category and custom subcategories to the appropriate categories under Budget using the Transfer functionality in LCRF (Leader and Clerk Resources Finance). Note: you may consider creating a custom subcategory under one of the standard Budget categories if appropriate.

- Inactivate custom subcategories in “Authorized Member Financed Activities” category after the balance is zero.

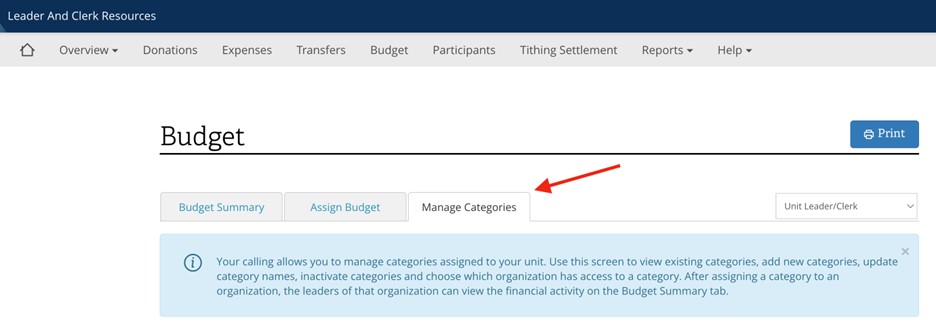

- Navigate to the Budget page and select the “Manage Categories” tab.

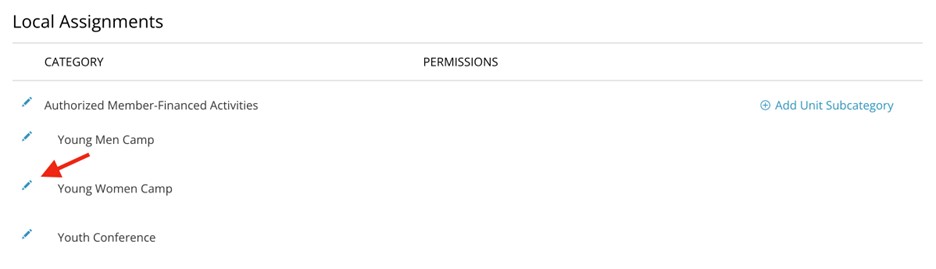

- Scroll down until you see the “Local Assignments” section.

- Click on the edit link (pencil icon) of the subcategory you want to inactivate.

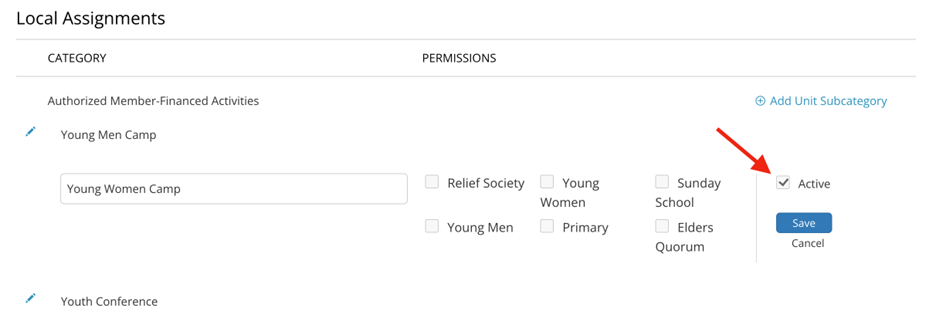

- Uncheck the Active checkbox and click the Save button.

- If the subcategory still has a balance, you will see an error message and the subcategory will not be inactivated. If this happens, please follow step 1 above.

- You cannot inactivate the parent category “Authorized Member Financed Activities.” Headquarters will discontinue it after the balance is zero in all the units in the country.

Frequently Asked Questions (FAQ)

How should I record youth participation contributions for camps going forward?

The process does not change: The member will still fill out a donation slip (“Tithings and Fast Offerings” form) and write the purpose on the “Other” space at the bottom of the slip (for example, “Young Women Camp”). The clerk will record it under the appropriate category using LCRF (for example, Budget: Young Women).

Is it appropriate to receive contributions to Budget?

“The budget allowance program provides general Church funds to pay for the activities and programs of stakes and wards. This program eliminates the need to receive budget contributions from members” (General Handbook: Serving in The Church of Jesus Christ of Latter-day Saints, 34.6, ChurchofJesusChrist.org; emphasis added).

However, leaders may ask youth attending camp to pay a fee following the guidelines detailed in section 20.6 of the General Handbook. This contribution may be recorded under the appropriate Budget category.

If we organize a fundraiser for youth camps as outlined in section 20.6 of the General Handbook, how should we record the collected amount?

Record the amount in the same manner you would record participation contributions for camps. Record the contribution under an existing category in Budget or create your own custom subcategory if appropriate (for example, Budget: Activities).

Will camp participation contributions be included in the Official Tax Statement?

No. Contributions to participate in camp activities or FSY conferences or to fundraising activities will not be listed as tax-deductible donations.

Is it appropriate to collect funds for anything other than the exceptions outlined in section 20.6 of the General Handbook?

No, this is not an approved practice. Please contact GSD (Global Services Department) if you have questions about how to proceed with any specific initiative you may have.